The Saturday Spread: Picking Out Empirically Intriguing Stocks Potentially Due for a Comeback (MCK, HON, AKAM)

Practically everyone these days emphasizes the importance of buying low and selling high — as if this philosophy were somehow profound and unique. It’s not. We’re just talking about a natural, human motivation. But seeking a discount is one thing; actually getting it is quite another.

As with any speculative activity involving the unknown future, any forward-looking methodology is necessarily going to be probabilistic. Thus, the idea here is to limit the number of assumptions and exogenous factors that could skew the odds disadvantageously.

One mechanism for optimistic speculators to limit their risk exposure — and thus raise their probabilistic profile — is to buy bull call spreads. This transaction involves buying a call option and simultaneously selling a call at a higher strike price. Essentially, traders use the credit received from the short call to partially offset the debit paid of the long call, resulting in a discounted bullish position.

Now, it’s true that the bull spread is a capped-risk, capped-reward options strategy. However, the discounting effect necessarily reduces the threshold to profitability, thus improving your odds of success.

Another mechanism to bolster the bulls is the deployment of pathway-dependent analyses. Over the last several months, I’ve focused on sequence-based pricing analytics. With this approach, I sidestep efforts to guess where the market may head using complex stochastic calculus and other esoteric formulations. Rather, I simply let the market tell me what it tends to do.

By no means is it a perfect model. However, with this unorthodox approach, we’re able to observe potential sentiment signals that we can exploit to our advantage. With that, below are three intriguing stocks that could be due for a comeback.

McKesson (MCK)

A pharmaceutical and health information technology specialist, McKesson (MCK) represents a reliable, large-capitalization entity. However, MCK stock has already gained nearly 25% since the beginning of the year, raising concerns about forward viability. Indeed, since the halfway point of 2025, MCK slipped about 2.91%. From a behavioral standpoint, though, McKesson is worth close examination.

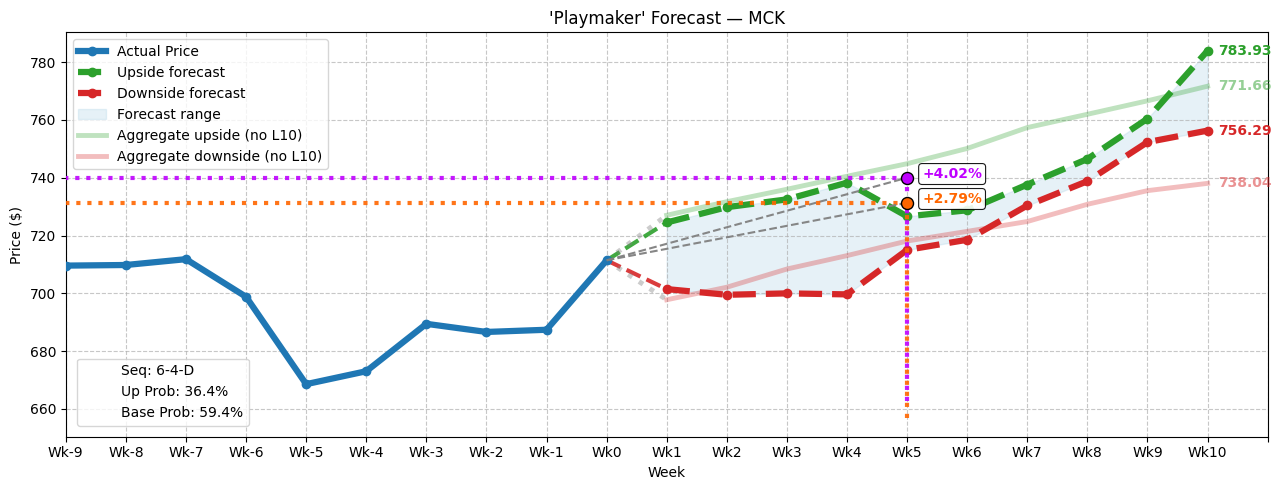

Quantitatively, the market has effectively voted to buy MCK six times and sell four times. Despite an accumulation-heavy sequence, the overall trajectory during this 10-week period has been downward. For classification, this sequence can be labeled 6-4-D. With a falsifiable signal identified, we can now use past analogs to map out how the market typically responds to it.

Essentially, the near-term projection for MCK stock isn’t favorable for the bulls, with a next-week upside probability of only 36.4%. That’s significantly below the baseline probability of 59.4%. However, over the long run, MCK tends to rise higher. Of the 22 times that the 6-4-D sequence has flashed, the security has swung higher almost 73% of the time over the next 10-week period.

Using data from Barchart Premier, the trade that arguably could be the most sensible is the 720/740 bull call spread expiring Oct. 17. Based on the positive conditional pathway of the 6-4-D sequence, the $740 target should be in play, though traders may need to consider exiting the spread early due to choppiness risks.

Honeywell (HON)

A multinational conglomerate, Honeywell (HON) is another historically reliable enterprise. However, circumstances haven’t panned out well for HON stock this year. Since the January opener, HON has declined by more than 6%. Since the halfway point of 2025, the industrial and applied sciences giant is down 9.2%. Still, the red ink may offer an opportunity for the contrarian-minded speculator.

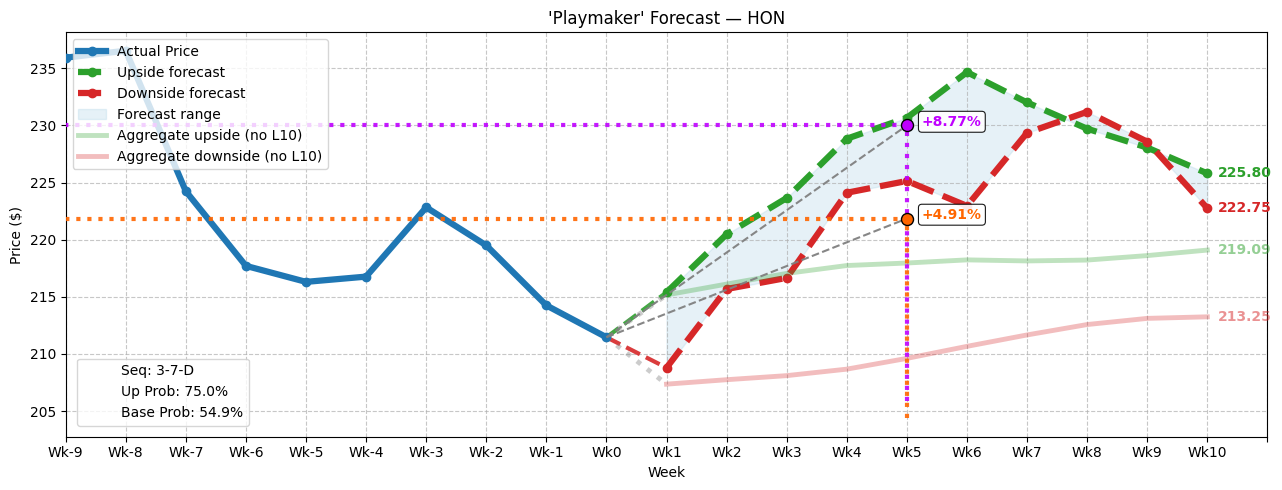

On a quantitative basis, HON stock has printed a 3-7-D sequence: three up weeks, seven down weeks, with an overall downward trajectory. Again, it might seem strange to characterize price behavior in a Morse-code-like language. However, this framework introduces falsifiability, making it much easier to identify behavioral patterns.

What makes HON stock stand out is that investors tend to jump on the 3-7-D sequence right away. In fact, the following week’s upside probability is 75%, much higher than the baseline probability of 54.9%. In addition, the sequence’s conditional drift tends to send HON higher over the next six weeks before incurring volatility.

Based on the market intelligence above, the 220/230 bull call spread expiring Oct. 17 is awfully tempting. With a breakeven price of $221.85, the trade is rational relative to past expectations. Plus, the payout of roughly 441% is difficult to ignore.

Akamai Technologies (AKAM)

In the tech sector, it’s easy to focus exclusively on headline innovations such as artificial intelligence. However, providing the services to ensure that the digital machinery operates smoothly is just as critical. From a fundamental point of view, then, Akamai Technologies (AKAM) deserves a closer inspection. Unfortunately, AKAM stock has struggled, slipping about 20% since the beginning of this year.

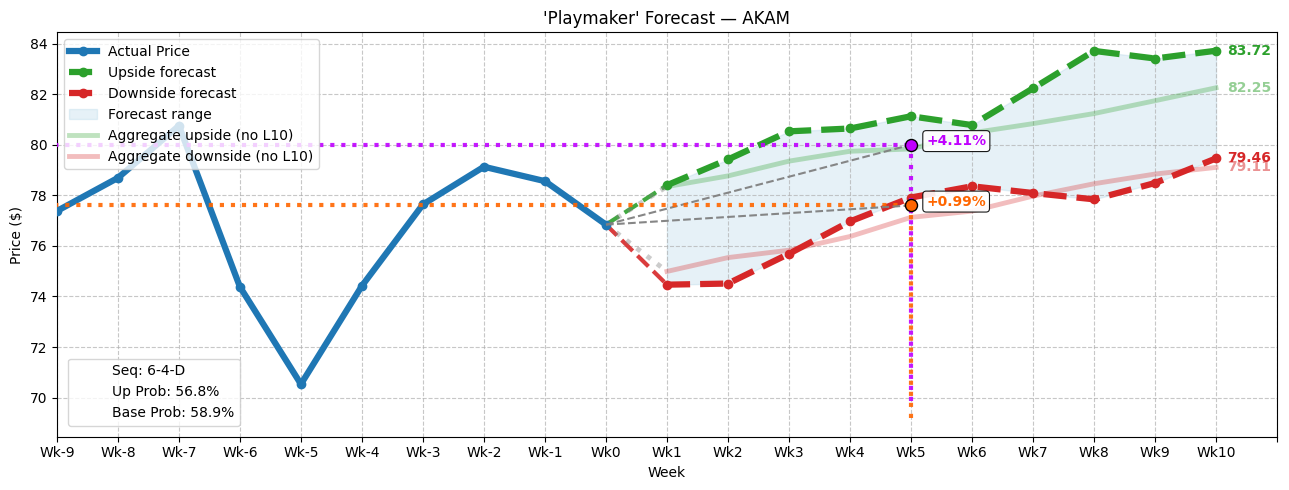

To emphasize anxieties, the Barchart Technical Opinion indicator rates Akamai as an 80% Strong Sell. From a quantitative perspective, AKAM stock has printed a rare 6-4-D sequence: six up weeks, four down weeks, with a downward trajectory. Given its apparent inability to generate positive momentum — with AKAM down 22% in the past 52 weeks — it’s reasonable to want to avoid the content delivery network (CDN) specialist.

Statistically, though, the 6-4-D sequence tends to generate an upward drift over the next several weeks. As such, contrarians may be interested in the 75/80 bull call spread expiring Oct. 17. Breakeven for this trade sits at $77.60, which would appear to be a quite reasonable target.

Those who are considering an extra kick may consider the 80/85 bull spread expiring Nov. 21. Here, the payout clocks in at over 170%, with breakeven landing at $81.85.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.