Grains rally in the face of larger crops while cattle ease

Howdy market watchers!

A lot has happened in our country this week with new tragedy paired with remembrance of the 9/11 attack on our democracy. It is unfortunate that differences must elevate to such a stage and while they say history doesn’t repeat itself, it rhymes. We thank our first responders this week and always and revel in every moment as tomorrow is not guaranteed.

It is time for local animosities to subside in our communities. That is not the battle, but yet it festers in many communities, particularly smaller communities where working together is most needed for the greater good to make the rising tide and thy neighbor more successful. Yet it continues to fester and ferment. Whether you’re a neighboring farmer or next-door small business, your competition is not them, it is the broader market, especially if you’re producing a commodity. The realization of this will build communities, recruit young people back to our rural communities as professionals and entrepreneurs which are desperately needed and hopefully create more collaboration among all of the above. I sense an issue with this in the communities that need it the most and it extends far beyond my zip code.

If you’re a commodity player, focus on least cost GLOBALLY with scale and timing the markets for better basis with on-farm storage. If you don’t want to scale, focus on specialty through Enterprise Grain Company and our associated companies. Commodity is increasingly not a place for everyone and with the expanse of Brazil, that challenge is becoming greater every season.

China this week approved grain sorghum from Brazil and they are improving their infrastructure and getting into every commodity market beyond just soybeans and beef. If that’s you’re focus, get ready as they are coming for us. For the commodity chess match, in addition to least cost, it is about futures pricing and basis timing, which requires your own storage infrastructure. That’s it. Do it well annually, or this reality will continue to dwindle your equity position.

The specialty game is always looked down upon from commodity players. I get it! But specialties can be rotation for the commodity players, but we must get weed control solutions figured out, I hear you! However, weed control may begin to become less of a concern when the global commodity market squeeze continues to tighten margins. Perhaps I’m unaware, but I do not see that happening.

Will the US-China talks set for Madrid, Spain, this next week yield anything material? I doubt it, but at some point, I would expect some soybean purchase announcements. However, I do think China is and has been making a strategic decision to ensure that South America generally and Brazil specifically sees ownership in China’s demand for soybeans and I’m sure other commodities. Can the consumer appetite of China be fed without the US farmer? That is THE question and one that China is working to answer as the US political prowess pushes back on the demand importance of the PRC. It is a chess game, but one that is much longer than each of our political cycles. China is finally approving GMO seed varieties to plant domestically as it has become in their interest to do so. They are a far cry from being self-sufficient, but they could make a dent on the need for US soybeans if domestic production increases on consolidated farms along with increased investment in port infrastructure and focus on Brazil, which is happening as we speak.

USDA’s monthly WASDE and Crop Production reports were released at 11 AM on Friday with mixed results. With corn and soybean yields in focus in the report, it was actually the acreage number that was more of the spoiler. US corn yields were in fact lowered from 188.8 bushels per acre (bpa) last month to 186.7 bpa on Friday, but the forecast for harvested acres was increased by 1.4 million acres! US soybean yields were reduced by 0.1 bpa to 53.5 bpa, but harvested acres were increased by around 210,000 acres over last month. Export demand was increased, but much was absorbed by the production increase from acres alone while yields were lowered.

Having said all that, the corn market rallied over 8 cents and nearly filled the $4.32 3/4 gap, closing Friday right at the 100-day moving average. The 200-day moving average is just above $4.39.

The hope for wheat follows corn without which traders are likely to focus on the enlarging crops in Europe, the Black Sea and Australia. KC and Chicago wheat contracts traded both sides on Friday, but managed to rally into the close and nearly reach the 20-day moving average. It is all but certain that we will get a 25-basis point cut from the FOMC this Wednesday, which could see the US dollar further selloff and support the commodity complex especially if there is a larger cut.

Soybeans also rallied after Friday’s report following an outside reversal day higher on Thursday. The upcoming China talks this week will be an important factor for the market to determine how strong and long this bullish sentiment can continue after USDA’s slight yield cut was also overshadowed by higher acreage. However, global ending stocks were cut more than expected.

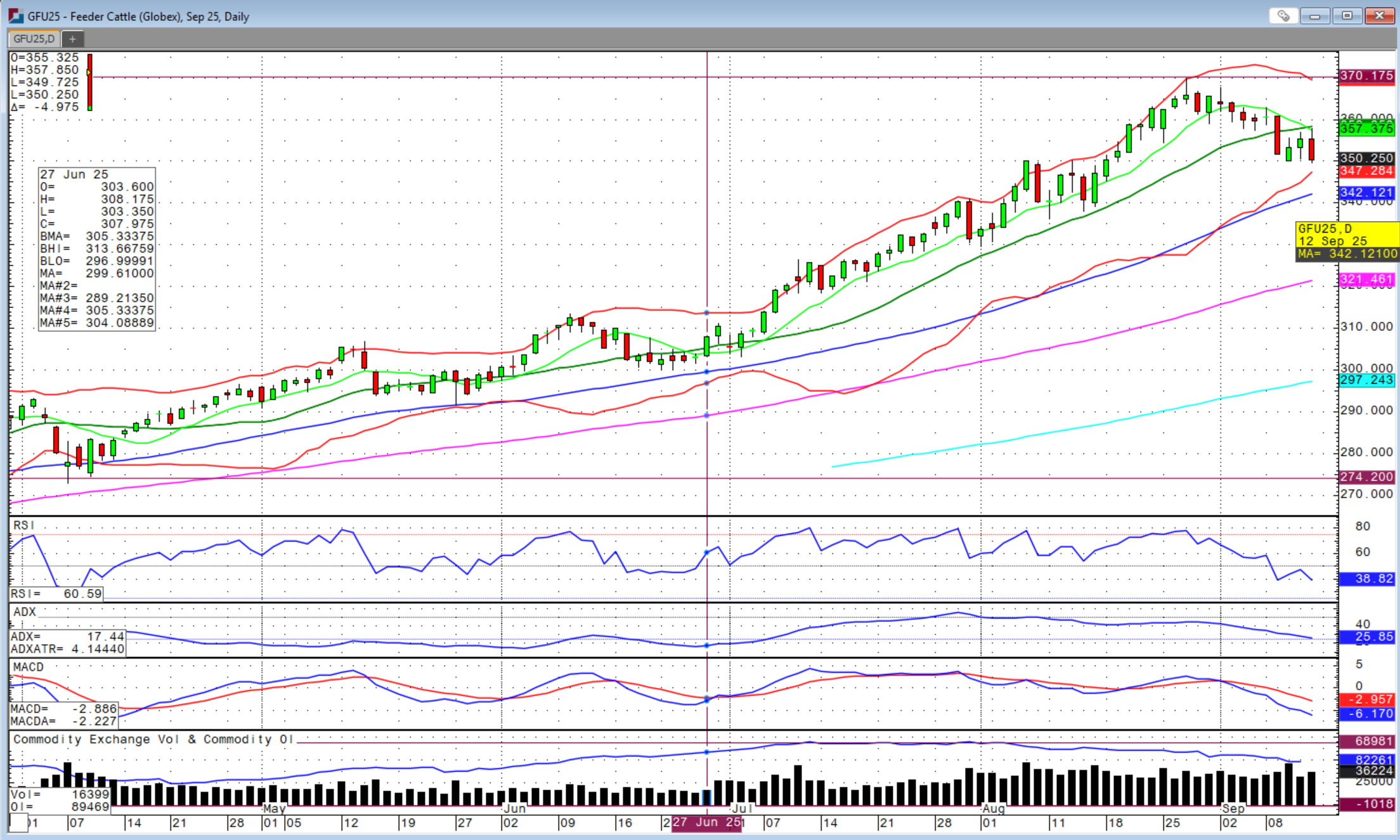

In the cattle complex, the market seems to be losing the upside momentum. After a limit down day on Tuesday sparked by the large adjustments to past US jobs data, I was fearful that we would see more weakness the following session with expanded trading limits. However, after making a new daily low, the market rebounded for the next two sessions before another selloff on Friday with feeders topping out at the crossover of the 9- and 20-day moving averages. Back months sold off more than the front month across feeder contracts with the futures looking destined to trade down to the 50-day moving average around $5-6 per cwt lower.

Meanwhile, cash trade in sale barns across the country continue to be on fire. Cash fed cattle traded at $240 in Texas and Kansas this week with front-month October live cattle futures all the way down at the $230 level. Futures across the cattle complex are trading at a discount to the cash, which has everyone feeling that the futures have to rebound for these prices to converge given it seems unlikely for the cash market to break that much lower to the levels where the futures contracts are trading. Live cattle futures also look set to trade down to the respective 50-day moving averages around $2.00 lower. We will have to see if this support holds.

Buyers are thinking this could be a good area to buy if cash markets soften even a touch while sellers are nervous for the same. If managed funds begin to exit the cattle futures despite strength in the cash markets and bullish fundamentals, it could get “Western” as we say. Be prepared and protect the downside of cattle you’re buying while keeping the upside open with put options or LRP. Call me for strategies and execution as that’s what we do.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.