How Is Brown & Brown's Stock Performance Compared to Other Insurance Stocks?

/Brown%20%26%20Brown%2C%20Inc_%20magnified-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

Daytona Beach, Florida-based Brown & Brown, Inc. (BRO) markets and sells insurance products and services in the U.S. and internationally. Valued at $30.9 billion by market cap, the company operates through Retail, Programs, Wholesale Brokerage, and Services segments.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Brown & Brown fits right into that category, with its market cap exceeding the threshold, reflecting its substantial size, dominance, and influence in the insurance brokerage industry.

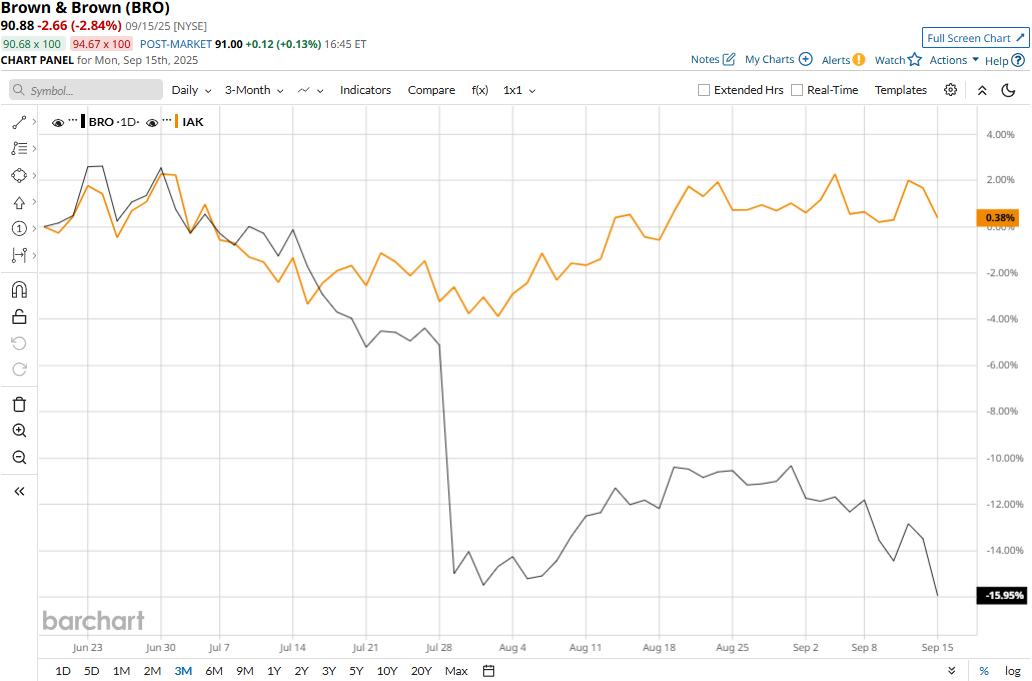

Despite its notable strengths, BRO stock has plunged 27.7% from its all-time high of $125.68 touched on Apr. 3. Meanwhile, the stock has declined 14.8% over the past three months, significantly underperforming the iShares U.S. Insurance ETF’s (IAK) marginal 33 bps dip during the same time frame.

Brown & Brown’s performance has remained grim over the longer term as well. BRO stock has plummeted 10.9% in 2025 and 11.9% over the past 52 weeks, notably underperforming IAK’s 4.4% uptick in 2025 and 3% gains over the past year.

Further, the stock has traded consistently below its 50-day moving average since late April and below its 200-day moving average since June, underscoring its bearish trend.

Brown & Brown’s stock prices plummeted 10.4% in a single trading session following the release of its mixed Q2 results on Jul. 28. Driven by organic growth and solid improvement in commission and fees collection, the company’s net revenues for the quarter increased 9.1% year-over-year to $1.3 billion, exceeding the Street’s expectations. Meanwhile, the company’s adjusted EPS increased 10.8% year-over-year to $1.03, surpassing the consensus estimates by 4%.

While the overall performance beat expectations, investor concern rose from a 520 bps contraction observed in profit before tax margin to 24.2%, down from 29.4% reported in the year-ago quarter. Moreover, the company’s GAAP-based EBITDAC margin also contracted by 450 bps to 33.8%, raising investor concern.

Meanwhile, BRO has also underperformed its peer, Arthur J. Gallagher & Co.’s (AJG) 2% gains on a YTD basis and 2.7% dip over the past 52 weeks.

However, analysts remain optimistic about the stock’s future. Among the 18 analysts covering the BRO stock, the consensus rating is a “Moderate Buy.” Its mean price target of $111.50 suggests a 22.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.