Can Bloom Energy Stock Hit $85 in 2025?

/Green%20hydrogen%20by%20Scharfsinn%20via%20Shutterstock.jpg)

Bloom Energy (BE) has been on quite a ride, pulling off a monster rally over the past year and building serious momentum. The company’s energy servers can turn natural gas or hydrogen into electricity without combustion. That means cleaner power from resources that are widely available, which couldn’t be more timely, given the exploding electricity demand, especially from power-hungry data centers fueling the artificial intelligence (AI) boom.

While investors have already been flocking to the stock, Wall Street analysts are also starting to take notice. On Sept. 16, Bloom Energy hit a record high of $73.42 after leading investment bank Morgan Stanley gave it a big vote of confidence. The investment firm not only took a positive stance on BE stock but also lifted its price target from $44 all the way to $85, which is also the most bullish target on the Street right now. So, can Bloom Energy really reach that target by the end of 2025?

About Bloom Energy Stock

Headquartered in Silicon Valley, Bloom Energy is redefining how enterprises power their operations, helping them meet soaring energy demand while maintaining control and sustainability. Its fuel cell systems provide ultra-resilient, highly scalable onsite electricity to some of the world’s largest organizations, including data centers, semiconductor manufacturing, large utilities, and other commercial and industrial sectors.

Lately, the company has been busy sharpening its focus on key growth drivers, including rising power demand from AI and data centers, faster time-to-power for new deployments, and greater fuel flexibility with natural gas, biogas, or hydrogen. Bloom Energy currently carries a market capitalization of about $17.2 billion.

Much of the investors' and analysts' enthusiasm for BE stock comes from July’s news that the company will soon start delivering on-site power to Oracle’s (ORCL) AI data centers using its fuel cell technology. And Oracle’s latest earnings report, published earlier this month, only added fuel to the fire, boosting Wall Street’s confidence that demand for Bloom’s solutions is set to rise.

The tech giant expects its cloud infrastructure revenue to surge 77% this fiscal year to $18 billion and reach a staggering $144 billion by 2030. That kind of growth means data center capacity will need to expand rapidly, and Bloom’s partnership with Oracle positions it perfectly to support that demand. That said, Bloom Energy has been one of the standout beneficiaries of the AI boom, and its price performance tells an incredible story.

Over the past year, the stock has skyrocketed an astonishing 700%, leaving the S&P 500 Index’s ($SPX) 18% gain far behind. Even in 2025 alone, BE is up a jaw-dropping 266%, while the broader market has only climbed 13% year-to-date (YTD). Currently trading very close to its all-time high level, Bloom’s stock reflects growing excitement around its role in powering the AI-driven future.

A Look Inside Bloom Energy’s Q2 Performance

Bloom Energy continues to shine with strong fundamentals. In its fiscal 2025 second-quarter report, released on July 31, the company recorded its third consecutive quarter of record revenue and profits, along with its sixth consecutive quarter of service profitability. Total revenue jumped 19.5% year-over-year (YoY) to $401.2 million, comfortably beating Wall Street’s estimate of $376.6 million.

The company allocates its revenue across four primary segments. Product sales led the charge, climbing a notable 31.2% YoY to $296.6 million, while Service revenues rose 3.7% from the year-ago quarter to $54.4 million. On the other hand, the Installation and Electricity segments faced some setbacks, with revenue declining 12.5% and 9.7%, respectively.

Profitability remained strong, with the gross margin rising to 26.7% in the second quarter, up 6.3 percentage points from 20.4% reported in the same quarter last year. On a non-GAAP basis, it rose even higher to 28.2%, marking a 6.5-point increase from the previous year’s 21.8%. Adjusted EPS came in at $0.10, a dramatic turnaround from a $0.06 loss per share in the same quarter last year and well above Wall Street’s $0.02 profit per share forecast, underscoring the company’s strong operational performance.

While reflecting on the Q2 performance, CEO KR Sridhar highlighted the company’s strong positioning amid the AI boom, saying that the demand for onsite power has “never been better.” The CEO emphasized that Bloom’s products are specifically designed for the digital era and expressed enthusiasm for collaborating with hyperscale partner Oracle to “optimize the watts to flops ratio,” underscoring the company’s focus on powering AI-driven data centers efficiently.

Bloom Energy has reaffirmed its full-year 2025 outlook, projecting revenue between $1.65 billion and $1.85 billion, a non-GAAP gross margin around 29%, and non-GAAP operating income in the range of $135 million to $165 million. Looking ahead, the company plans to double its factory capacity from 1 GW to 2 GW by the end of 2026, signaling strong growth potential.

What Do Analysts Think About BE Stock?

BE popped nearly 9.4% on Sept. 16 after Morgan Stanley gave the stock a big lift, citing its growing role in powering AI data centers. Analyst David Arcaro raised his price target from $44 to $85 while keeping an “Overweight” rating, highlighting Bloom’s strong positioning in the booming AI data center power market.

Arcaro’s optimism follows Oracle’s recent announcement of massive bookings that beat expectations, with its backlog jumping $317 billion sequentially to nearly $0.5 trillion. This comes on the heels of Bloom’s July agreement to supply fuel cell power to Oracle’s AI data centers. According to Arcaro, Bloom is now “favorably positioned for success in powering AI data centers,” as demand for data center electricity skyrockets.

The analyst highlighted that the market for power is tightening fast, with both grid and alternative solutions facing longer delays. Bloom’s edge lies in its manufacturing flexibility. It can double capacity in under six months and ship products quickly. With a potential power shortfall exceeding 40 GW in the coming years, compared to Bloom’s current 1 GW annual capacity, the growth opportunity is huge.

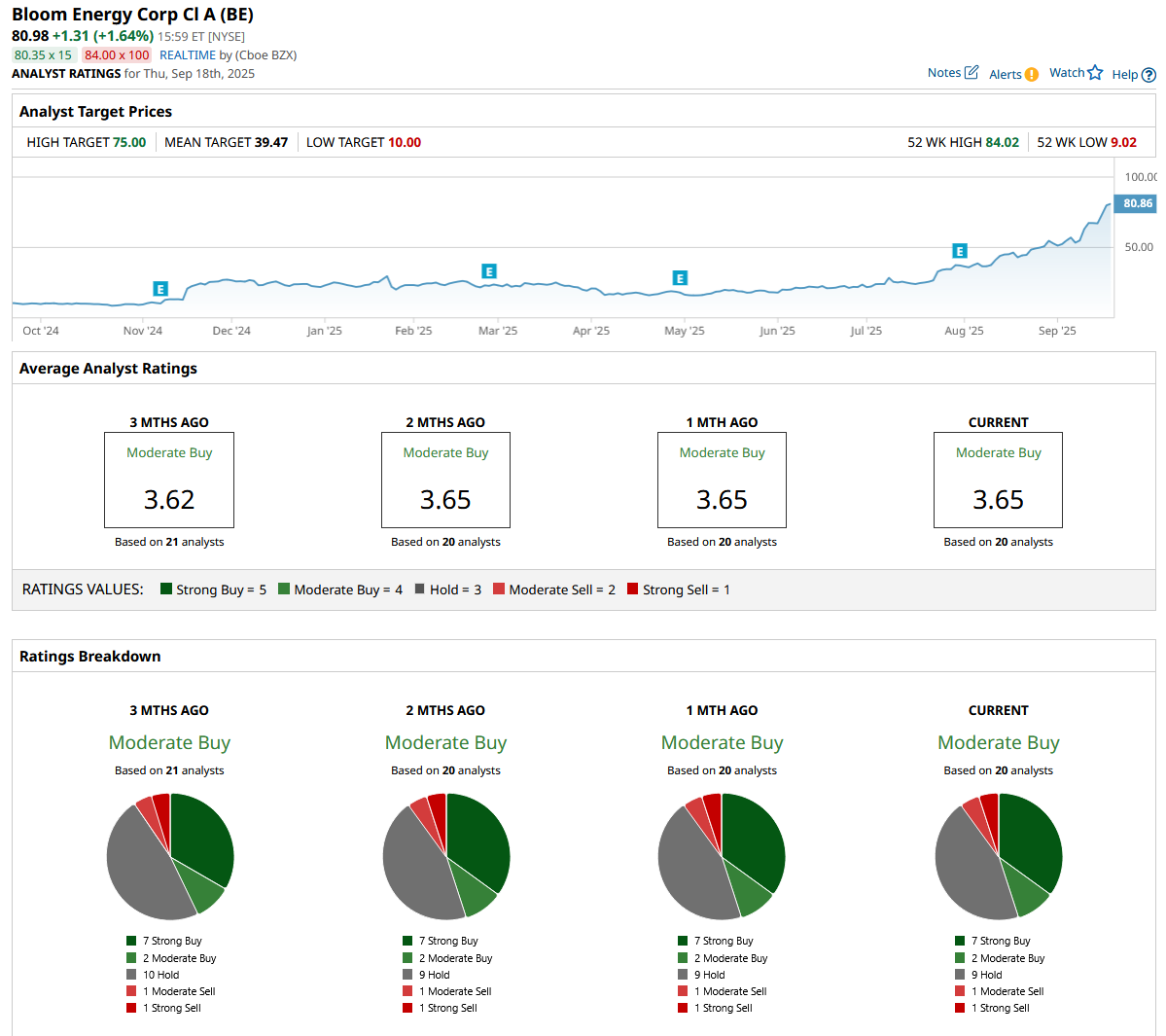

Overall, Wall Street remains optimistic about BE, with the stock carrying a consensus “Moderate Buy” rating. Among 20 analysts covering the stock, seven call it a “Strong Buy,” two lean toward a “Moderate Buy,” nine have issued a “Hold,” one advocates a “Moderate Sell,” and the remaining one gives a “Strong Sell.”

Even after its explosive rally, which has pushed the stock well above the average analyst price target of $39.47, there’s still room for upside. Morgan Stanley’s most bullish target of $85 implies roughly 16% more potential from current levels, suggesting that Bloom could continue to climb and possibly reach new all-time highs as investor confidence and demand for its clean energy solutions grow.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.