This AI Stock Has More Than Doubled in 2025. Is It a Buy?

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)

Artificial intelligence (AI) has been the market’s favorite catalyst over the past year, fueling rallies across everything from chipmakers to cloud software stocks. But one of the more surprising success stories has come from healthcare, a sector not usually known for flashy AI-driven growth. That’s where Tempus AI (TEM) enters the picture. Going public just last year, Tempus is already experiencing sharp revenue gains and notable improvements in the bottom line, unlike the typical biotech IPOs that often hit the market with little revenue and long development timelines.

The company leverages one of the world’s largest multimodal data libraries to power AI tools that help physicians deliver personalized treatments while accelerating drug discovery. And investors are certainly taking notice, sending TEM shares soaring triple digits in 2025. That being said, does this AI-driven healthcare innovator still have more room to run?

About Tempus AI Stock

Founded in 2015, Illinois-based Tempus AI is a healthcare technology company that blends advanced data and AI to support doctors, researchers, and drug developers. Its work spans from next-generation sequencing and molecular testing to a broad suite of digital platforms. The company offers genomic profiling, AI-powered diagnostics, and data services across various diseases, including oncology, cardiology, and psychiatry, with the goal of improving outcomes by linking patients to optimized therapies and the proper clinical trials.

Valued at roughly $15 billion by market capitalization, Tempus AI has attracted massive investor attention by placing AI at the center of healthcare innovation. Most recently, the stock jumped over 13% on Sept. 11 after the U.S. Food and Drug Administration (FDA) granted clearance for an upgraded version of Tempus Pixel, its AI-powered cardiac imaging platform that delivers highly precise heart scans. The healthcare tech company believes this move will fuel its growth while also advancing breakthroughs in medical science.

Despite being a relative newcomer on Wall Street, Tempus’ stock has already delivered eye-popping returns. Over the past 52 weeks, shares have soared about 69.2%, leaving the broader S&P 500 Index’s ($SPX) 18.07% gain in the dust. And the rally has only intensified in 2025. Year-to-date (YTD), TEM is up an astonishing 157.1%, compared with just 12% for the broader index. After achieving a 52-week high of $91.45 in February, the stock remains resilient, down just 5% from that peak.

A Look Inside Tempus AI’s Q2 Performance

Tempus AI kicked off its fiscal 2025 second-quarter earnings on a strong note. On Aug. 8, the company reported revenue of $314.6 million, smashing Wall Street’s estimate of $299.3 million and marking an impressive 89.6% year-over-year (YoY) increase. The announcement sent shares surging 3.6% on the same day, highlighting investor enthusiasm for the healthcare tech company’s strong topline momentum across its genomics and data services businesses.

Genomics was the star performer. Revenue in this segment soared a whopping 115.3% YoY to $241.8 million, fueled by accelerating volume growth in both Oncology testing and Hereditary testing. Oncology testing led the charge with $133.2 million, up 32.9% YoY, while Hereditary testing added $97.3 million, climbing 33.6%. The company’s Data and Services division also delivered strong growth, with revenue rising 35.7% YoY to $72.8 million, driven by the Insights division, where data licensing jumped 40.7%.

Profitability also saw a remarkable lift. Second-quarter gross profit jumped to $195 million, reflecting a staggering 160% YoY increase. The boost was driven by improved cost management and a strategic shift toward higher-margin products, demonstrating that Tempus isn’t just growing revenue but doing so efficiently.

Operational efficiency is improving dramatically. Adjusted EBITDA narrowed from a negative $31.2 million in Q2 2024 to a negative $5.6 million in Q2 2025, highlighting the company’s stronger cost discipline and operational leverage as its scale increases. Meanwhile, the adjusted loss per share came in at $0.22, a notable improvement from the $0.63 loss reported in the same quarter last year and slightly better than Wall Street’s forecasted $0.23 loss per share.

Financial flexibility received a boost post-quarter. Shortly after the period ended, Tempus completed an upsized $750 million 0.75% convertible senior notes offering, strengthening its balance sheet and allowing the company to refinance a portion of its term loan with a much lower-interest debt instrument. Meanwhile, cash and marketable securities ended the quarter at $293 million, roughly $70 million higher than the prior quarter, underscoring the company’s commitment to financial stability.

Looking ahead, Tempus raised its guidance. With a strong second-quarter performance, the company now expects full-year revenue of roughly $1.26 billion, implying 86% annual growth. Adjusted EBITDA is projected at $5 million for the year, representing a $110 million improvement over last year, reflecting the company’s growing scale, operational efficiency, and focus on high-margin businesses.

What Do Analysts Think About TEM Stock?

H.C. Wainwright recently raised its price target on Tempus AI to $98 from $90, keeping a “Buy” rating in place, following FDA clearance of the upgraded Tempus Pixel, the company’s AI-driven cardiac imaging platform. The firm highlighted its confidence in TEM, citing the company’s effective execution of its strategy to expand its footprint in radiology and pathology through strategic acquisitions and the use of cutting-edge AI algorithms for precision medicine, positioning Tempus as a standout innovator in healthcare.

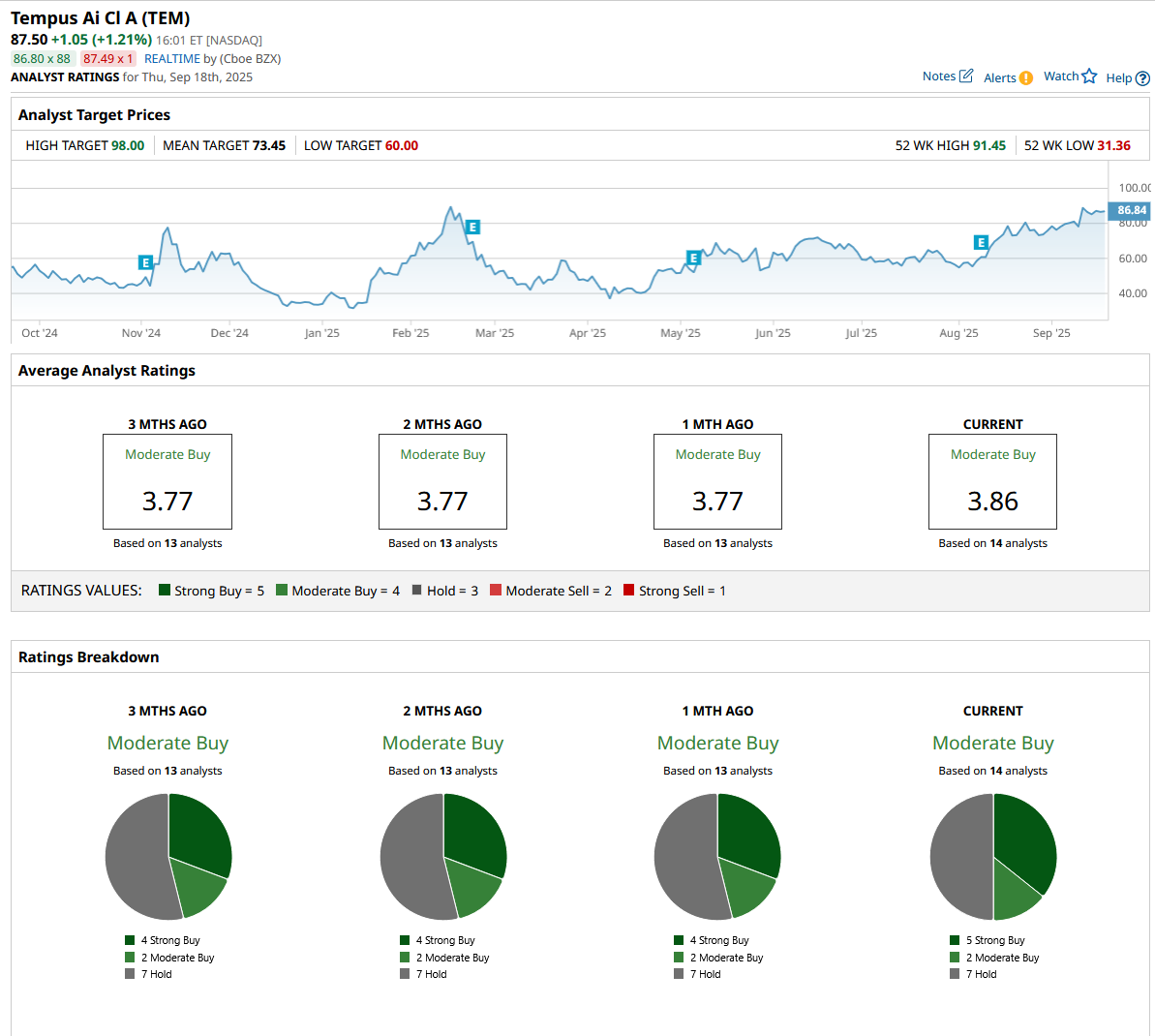

Overall, Wall Street remains positive on TEM, with analysts giving it a consensus “Moderate Buy” rating, reflecting steady confidence in its potential. Among 14 analysts covering the stock, five call it a “Strong Buy,” two lean toward a “Moderate Buy,” and the remaining seven have issued a "Hold" rating.

While the stock’s explosive rally this year has pushed its share price above the average analyst price target of $73.45, H.C. Wainwright’s newly assigned Street high target of $98 suggests that the stock can still climb as much as 12% from current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.